Strategic Advisory

Restructuring & Turnaround.

Our Strategic Advisory Philosophy

IFG Asset Management is uniquely positioned to provide innovative solutions to clients involved in distressed situations, allowing clients to minimize cost and properly position themselves for the future. The Firm is positioned to source capital from an extensive network of debt and equity providers to support clients as they navigate the restructuring and turnaround process.

Despite the negative connotations associated with restructuring, a reorganization can provide a fresh start for Company’s from their creditors and may provide an opportunity to unravel any uneconomic business arrangements, allowing for the necessary breathing room to create a plan of reorganization. As a result, more and more organizations consider restructuring as a viable option.

IFG’s senior team helps drive successful restructuring & turnaround plans through our extensive network of executive level professionals and operators, with a focus on maximizing outcomes for all stakeholders.

Who We Represent

IFG represents distressed companies, board of directors, C-suite management teams, shareholders, lenders, unsecured creditors, outside investors and acquirors in both in-and-out-of-court restructuring transactions.

Areas of Focus

Challenging stakeholder negotiations

New debt and equity financing

Debtor in possession (DIP) financing

Asset Purchase and 363(b) sale

Other liquidity enhancement initiatives

Distressed direct investing

Contingency planning

Turnaround business plan and execution

Traditional Chapter 7 & 11 restructurings

International recapitalizations

Lender advisory services

Special situations

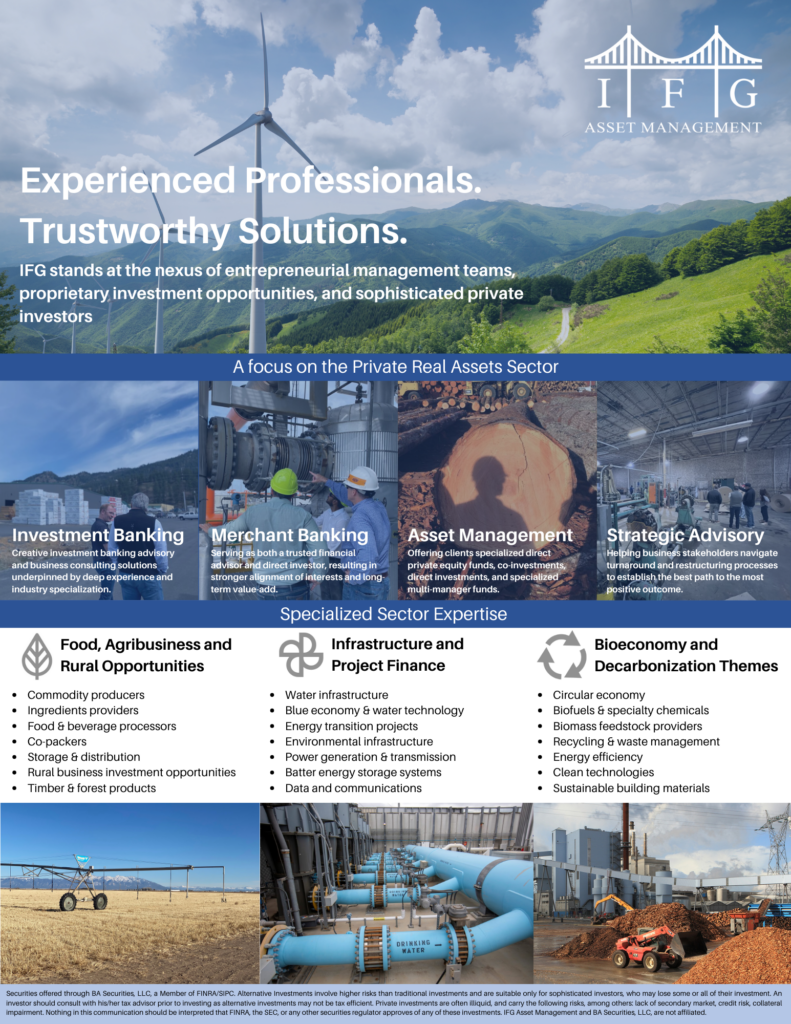

Experienced Professionals.

Trustworthy Solutions.

Delivering Successful Outcomes

We specialize in providing unbiased advice to clients in distressed situations. We help author and implement transformative business plans to guide a Company through a successful turnaround and maximize returns for all stakeholders.

Through our hands-on-approach, we analyze restructuring scenarios, perform in depth financial and operational due diligence, raise new debt and equity as needed, evaluate asset sales and business divestiture strategies, and leverage our deep expertise to negotiate and obtain terms most favorable to the company.

Let’s Talk

Connect with us to learn more about our industry-focused approach to advisory engagements and our proprietary investment programs

Download Our Brochure

Learn more about our specialized sector expertise, our investment approach, and spotlighted transactions.